Running a business out of your house has many rewards: no commute, less time-sucking small talk, no missed time with your family.

But before you settle into the bliss of this heaven on Earth, remember that, in the end, you are still running a business. Working from home has all kinds of pitfalls that need to be avoided if you are to succeed.

Here are five no-nos to avoid when running a business from the comforts of your abode:

1. Working in your pajamas

The process of getting ready for the day and commuting to an office creates a useful transition between home life and work life, notes writer Carol Tice on her Make a Living Writing blog.

“Staying in bed and not getting dressed = no transition,” Tice writes. “Lots of hanging out on Facebook often follows.” Simply put, nothing gets done.

Tice doesn’t sit around her house in a suit every day, but she does get dressed every morning in something casual that signals that it is time to get to work. Think a stretched, long-sleeve cotton shirt and chinos with a sweater.

“My attitude is, I’m in business. I’m serious about it. So I’m dressed and ready,” Tice says.

And while you’re at it, remember to shower and brush your teeth before you dress, too.

2. Not having a home office

Having a space in your home that is dedicated exclusively to work also helps, career expert Kerry Hannon writes in Forbes. “You’ll be able to deduct it from your taxes, and it will help you psychologically.”

Not having a home office can be like leaving money on the table, since the federal government offers home office tax deductions. In recent years, the Internal Revenue Service (IRS) has made things much easier for people with home offices, offering a simplified deduction for filing: $5 per square foot for a home office (up to 300 square feet).

Avoid skimping on the home office, too. Remember that this is where you could be spending hours of your day. Deb McAlister-Holland, a freelance marketing professional in the Dallas-Fort Worth area, tells Inc.com that the $5,000 she spent on her home office provided a major boost to her productivity. “I love my home office. It has a big leather sofa, three walls covered with built-in bookshelves and storage cabinets, dedicated circuits for my computers, special lighting, and a soft hand-woven rug on the floor which is the perfect spot for my dog to nap while I work,” McAlister-Holland says.

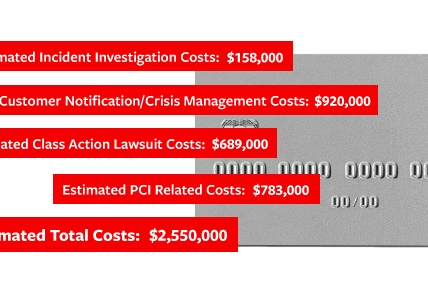

3. Not covering your home office

If you have clients or customers coming into your home, if you store customer data on your computer or if you’re shipping and receiving (or just storing) product in your home, you probably need a home-based business insurance policy. Don’t mistake the coverage your homeowners policy gives you for business coverage.

4. Compartmentalizing work and home

Drawing a line between work life and home life can be an unrealistic goal, especially for situations in which spouses work together or the kids are at home for all or part of the workday. However, it is an essential part of the ways to ensure that your business doesn’t swallow your life.

“The goal should instead be to figure out how to seamlessly transition from one to another,” Evrim Oralkan, founder and CEO of Travertine Mart, an online-based flooring retailer, writes in Entrepreneur. “Instead of fighting to keep work and home separate, embrace the overlap, and use it to make your relationship even stronger,” Oralkan says.

That could mean, for example, having lunch with your spouse on days when you’re both at home and available or devoting a little time during the workday to talk with the kids about their school day.

5. Doing the dishes—and falling to other distractions

It is still very important, though, to figure out how to prevent your home life from distracting you too much from daily work tasks. It can be tempting, for example, to do household chores, run personal errands, call friends or browse the Internet when working from home instead of from an office.

Having a home office can help you stay focused on work, but so can setting up some boundaries. Committing to working specific hours of the day—and then reminding your family members and friends that you’re not available during those hours—is a good way to create some structure and forced discipline in your work day. Limiting distractions, such as by closing your office door and not checking your social media accounts or personal email during your designated work hours, can help you stay on task.

You also might follow the advice of business consultant Perry Marshall in Entrepreneur to hire a housekeeper to clean your home so that you have time to do the much more lucrative work related to your business and aren’t distracted by the urge to clean during the workday.

“As a go-getter, your core entrepreneurial skills can earn you hundreds of thousands of dollars a year. So there’s no reason why you should be scrubbing your own toilets,” Marshall says.

6. Staying at home all day

A change of scenery can help ward off a mid-afternoon nap, according to tech entrepreneurs Jason Fried and David Heinemeier Hansson in Business Insider. And getting to a coffee shop or library has other benefits.

For example, having other people around, even if they might be strangers, can trick you into thinking that being productive is the only acceptable thing to do, Fried and Heinemeier Hansson write in their book, “Remote: Office Not Required,” as relayed by Business Insider.

Other helpful options include taking a break to get some fresh air, grabbing lunch with an associate or friend, and attending networking events. Also remember that there are many communications tools out there to “virtually” meet someone else outside the house, from Skype to Google Hangouts.

Too often, working from home can feel like a staycation and sap productivity. So arranging meetings can help refresh your brain and energize you toward getting more business done.

These advice points should help you stay productive as you build your business from home, even as you reap the benefits from not having to drive twice a day or miss out on important time with your family.

_428_428_c1_c_c.jpg)

_428_428_c1_c_c.png)

_428_355_c1_c_c.png)